By Tom Gerbe – Defense Information Analyst – BidLink.net

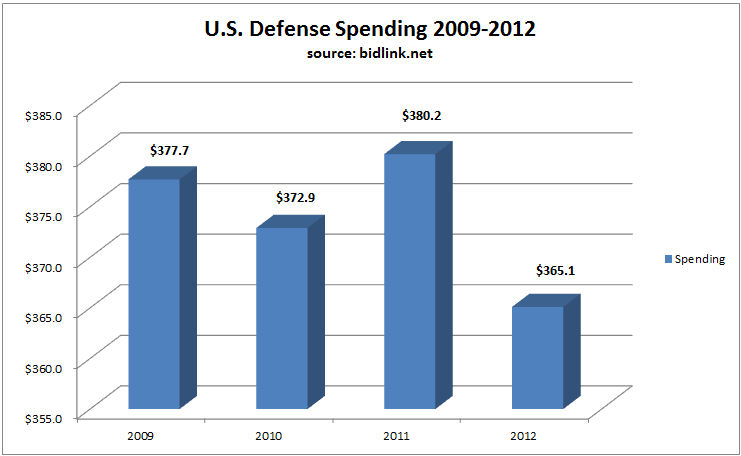

Ahead of the sequester, the Defense Department has already implemented significant cuts in defense spending. Defense spending dropped $15.1 Billion from FY 2011 to 2012 and this is before the eight percent across the board cuts are implemented starting March 1. Unlike the sequester, the reduction of spending in 2012 was not evenly distributed through the top four major procurement agencies. Data from the procurement history database at BidLink.net shows that the departments of the Army and Navy saw a reduction of $ 18.5 billion and $ 9.9 Billion respectively, while the Air Force and Defense Logistics Agency saw increases of $4.1 Billion and $7 Billion.

A significant increase in spending for airframe structural components (Federal Supply Class 1560) was noticed, rising $3.3 Billion, $4.8B and $5.5B for 2010, 2011 and 2012. Many large contracts were awarded to prime contractors including Boeing (NYSE: BA), Lockheed Martin (NYSE: LMT), EADS North America, McDonNell Douglass, Northrop Grumman (NYSE: NOC) and MD Helicopter. Boeing received the largest contract for this supply class in 2012, through a modification to contract number N0001909C0022 for the purchase of eleven P-8A Multi-Mission Maritime Aircraft. This modification for $1.9 Billion was issued in September of 2012 to be completed by May 2015. Eighty Six percent of this contract will be executed in the United States in areas including Seattle, Washington; Baltimore, Maryland; McKinney, Texas; Greenlawn and North Amityville, New York.

There was a surge of spending in the third quarter of 2012, followed by a twenty two percent drop in the fourth quarter according to the Bureau of Economic Analysis. Some of the quarterly decline is a cyclical drop due to the fiscal year ending in September, but much of the annual drop is a decrease in spending. This reduction in defense spending is primary cause of the almost 1.3% decline in GDP.

BidLink.net is a provider of defense industry information for contractors worldwide. This data includes millions of defense contracts, procurement history, part numbers and vendor details. This unique combination of resources allows BidLink to monitor and extract important information for the defense contracting industry. BidLink.net, based in Washington, D.C., provides bid search and notification services, competition analysis as well as part number (NSN) lookup to many military activities and thousands of private companies around the world.

For the news and tools to compete in the defense industry, go to www.bidlink.net.

Tweet