This week a new government solicitation was issued which will result in a Long Term Contract (LTC) for several styles of commonly used grease fittings. These grease fittings otherwise known as lubrication fittings or Zerk fittings are used virtually in anything that moves. The US Military uses them in everything, it’s a common repair part replaced when it fails. The one most commonly used is the straight one, the National Stock Number (NSN) is 4730-00-172-0010. In fact DLA purchases over 100,000 units per year. This NSN 4730-00-172-0010 has the official item name of “Fitting, Lubrication”. The Department of Defense forecasts an Annual Demand Quantity (ADQ) of 190,625 of these grease fittings. The government solicitation SPE7MX-18-R-X040 closes June 8, 2018 and the requirement includes 14 other similar styles of lubrication fittings with lower quantities.

A couple factors caught our interest in this solicitation

On December 22nd 2017 a defense contract for the exact same group of 15 NSNs was awarded to Jamaica Aerospace Company (AKA Jamaica Bearings) CAGE code 12516. The total estimated contract value was listed at $800,000.00. The Government received only 3 responses to the solicitation SPE7MX-17-R-0085 which resulted in this award to Jamaica Aerospace. The contract award SPE7MX-18-D-0040 is an IDC – Indefinite Quantity Contract which they are currently delivering product under. It consists of a three-year base period with two one year option periods. It was issued by the DLA Land and Maritime, Strategic Material Sourcing Group division. The new solicitation SPE7MX-18-R-X040 is out of the same office also with a three-year base period with two one year option periods for the same list of items.

The second factor which was interesting is the huge price jump of 1,277 percent of the NSN with the highest volume. After reviewing past procurement history, actual PDF contracts and DLA unit prices back to 1989 pricing for NSN 4730-00-172-0010 remained basically unchanged. Current DLA unit cost associated to this NSN (based on past activity) is set at $0.22 per unit or $5.50 per package of 25. Now according to the latest contract awarded to Jamaica Aerospace they now cost $3.03 per unit or $75.70 per package. These prices are based on government purchases on over 466 packages (per order) as that’s the price break point. Orders under 466 price out at $5.18 per unit or $129.39 per package of 25.

Overall this is a huge price increase going from $0.22 each unit to $3.03, what happened?

We reviewed procurement history (contract awards) of this NSN as well all the companies CAGE code classifications over the past 10 years. Most all of the companies listed as past suppliers for this grease fitting were distributors or dealers including Jamaica. Many of the companies received contracts for this NSN only to have them cancelled soon thereafter for unknown reasons.

NSN Analysis

First here are some NSN basics – Every NSN is associated to one or more reference numbers along with a CAGE code, these numbers are listed in the Master Cross Reference List (MCRL) section. These reference numbers have various purposes such as defining the number as either a manufacturers part number, specification or drawing number.

This NSN 4730-00-172-0010 lists 50 distinct reference numbers along with 50 different companies and 54 distinct CAGE codes this is more than most NSN’s. The majority of the CAGE codes associated are manufacturers, most of them prime manufacturers like General Motors or Oshkosh Defense. These companies are ones that would typically use grease fitting in their products and not make them, that’s why you see so many numbers. The others were listed as non-manufacturers many of them obsolete CAGE codes. Typically one or more manufacturers are listed in the MCRL section and of this entire list we only found two CAGE codes that possibly specialize in manufacturing grease fittings or Zerk fittings. They are CAGE 36251 McNeil Ohio Corporation and 0FKM1 Alemite, neither of them are active in the SAM database www.sam.gov or have sold direct to the government in many years.

History on lubrication fittings or Zerk fittings

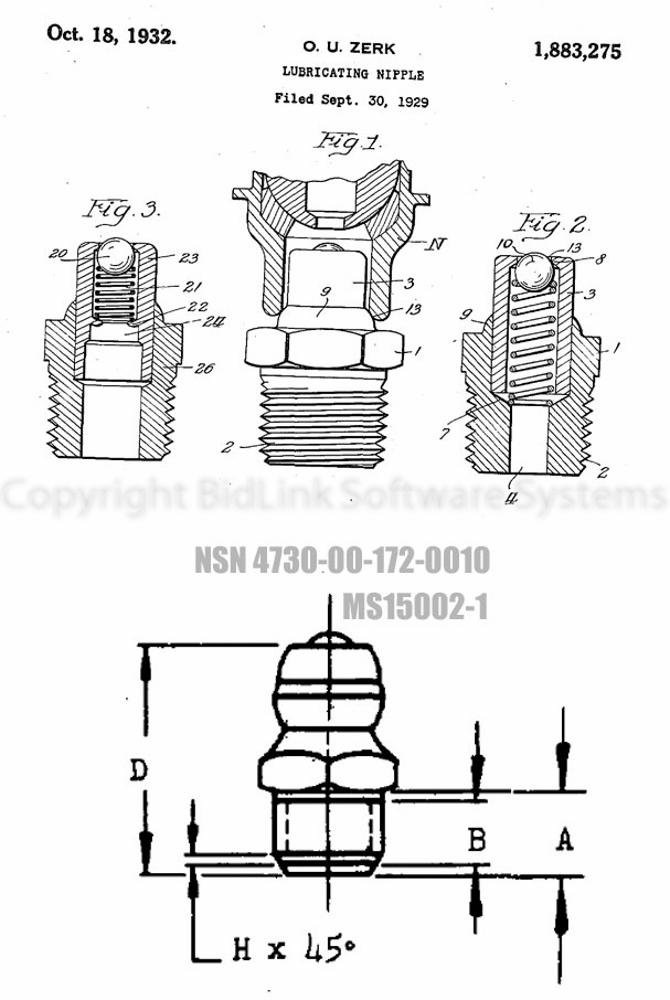

Alemite LLC a manufacturer of grease guns (lubricating guns) was purchased by the Allyne-Zerk Company back in the year 1924. Oscar U Zerk an inventor designed a new style of lubricating nipples which improved on the previous designs. October 18, 1932 Oscar U Zerk and assignee Alemite Corporation received patent number 1,883,275 for this new design. The lubrication nipple or fitting in this patent drawing looks relatively unchanged from the grease fittings we use today some 86 years later. See the Military Specification MS15002-1 and MS15002-2 as a comparison.

McNeil Ohio Corporation purchased Lincoln Industrial in 1955 they also specialized in lubrication and fluid pumping products. Today they operate under the name Lincoln Industrial. Both Lincoln and Alemite operate under the SKF Group which is headquartered in Gothenburg Sweden. SKF USA Inc. CAGE code 52676 is the only active CAGE code currently selling to the US Government.

Specifications and Drawings

This open solicitation states that the drawings/specifications are available for any bidders. Most are SAE specifications or standards based on obsolete military specs. We have gathered a few of the mil-specs for you to review here. MIL-F-3541 is the general specification for lubrication fittings; MIL-F-3541 and the actual drawing MS15002 for the most commonly purchased Lubrication fitting. However you will need to obtain the current SAE standards to quote.

Manufacturing of grease fittings

Part of our research included reaching out to a machine shop to gain some professional thoughts.

“A machine shop with a screw machine should be able to produce the grease fitting you described” was the comment from a prototype machine shop we spoke to – Thanks 4M Instrument & Tool LLC.

In conclusion these were our findings based on the available data

- The US Government for this most commonly used grease fitting has limited manufacturer.

- A 1,277 percent price hike – from $0.22 cents to $3.03 dollars each means something.

- Competition for manufacturers of grease fittings is low.

- Competition for government sales of grease fittings is low, only 3 submitted bids last time.

- The current government solicitation closes on June 8th 2018, and is for same list of items.

If you are a manufacturer looking for defense contracts this is one item worth looking into.

BidLink has been a leading provider of industry marketing data relating to DoD procurement for the past 18 years.

Tweet